Introduction

Whilst homeowners are concerned about interest rate rises and how to meet the extra monthly costs on their mortgages, the effect on the amount of total interest payable over the life of the mortgage means that homeowners are literally going to be hundreds of 000s out of pocket from recent interest rate hikes.

Here I break down the monthly income loss from higher payments and the lifetime loss from all the extra interest paid. I will then show ways to mitigate this in the next five years and how that can save save thousands.

Rising Interest Rates

Mortgage rates have risen dramatically in the UK and elsewhere in the past six months. Many homeowners are worried about the income hit they will take when their mortgage rate rises.

Meanwhile non-home owners are silently praying for a housing crash whilst wondering how they will get enough money to buy a house against a backdrop of rising rents.

Tighten Your Belt … ?

As mortgage repayments take more income from clinic owners, the default reaction when things are hard is to think, tighten the belts, reduce savings, change holidays etc.

When I originally thought about this article, I started thinking purely in terms of how much extra income a clinic owner would need to make each month to cover the cost of the extra mortgage payments.

But as I started looking at the numbers on a mortgage rate calculator, I noticed the section which shows total amount repaid over the life of the mortgage. The differences surprised me, and maybe it shouldn’t have, but we are so used to low interest rates.

I looked at the total amount of interest payable over the life of a mortgage today, compared to a mortgage just three years ago. Now these are scary numbers, literally hundreds of thousands for some people.

Impact Of Rising Interest

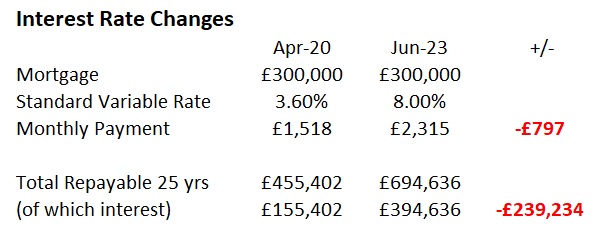

There are fixed deal rates, but these change daily. So I make this illustration using the Standard Variable Rate (SVR).

I have used rates from Metro Bank because they were easiest to find historic rates for, but the principles are the same whoever your mortgage is with, rates have risen a lot.

1st April 2020: 3.6%

6th June 2023: 8%

Based on a £300,000 mortgage over 25 years with no fees, this is the difference.

Calculations using https://www.moneysavingexpert.com/mortgages/mortgage-rate-calculator/

Mortgage Payments

Monthly repayment on the standard variable rate in 2020 is £1,518 per month, whilst in June 2023 the monthly payment has increased to £2,315.

A massive increase of £797 per month.

The total interest on a mortgage at 2023 interest rates versus the rates in 2020 is a HUGE £239,234 extra interest paid.

If we divide that lost income by the 25 year mortgage term, that equates to a loss of £9,569 per year (averaged out). That is more than most people put into their pension as it is.

Not only is this less money each month, it is also the opportunity cost of not having that money today to invest for the future. So it’s a double whammy.

I am SHOCKED.

We all like big headlines, save £100,000 usually gets attention or elicits groans as it such a cliché number.

But here is the thing.

If you made an extra £10,000 a year net over the next five years and put that to this mortgage, you would cut your mortgage and over the life of it save £000s, even over £100,000 depending on your circumstances.

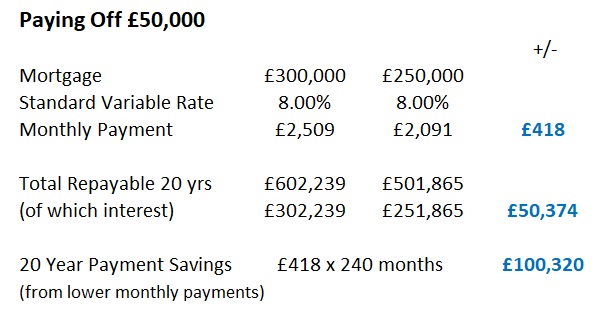

You can do this exercise with your own mortgage if you paid off £50,000 from it.

I have not calculated how much of a £300,000 mortgage would actually be left payable after five years of payments because of complicated proportions of interest and capital repayments in the calculation.

So I just use £300,000 and £250,000 to illustrate the effect of a £50,000 payment on a 20 year mortgage at the current standard variable rate at Metro Bank of 8%.

Monthly Payment

A mortgage balance of £300,000 at today’s standard variable rates gives a monthly payment of £2,509 whilst for £250,000 it is £2,091 per month.

The difference in total lifetime interest payable on a £250k mortgage versus a £300k mortgage was less than I expected, but still, it is over £50,000.

Worth having. But, let us look at the difference in monthly payments.

By paying off £50,000 from a mortgage in five years time, the monthly payments thereafter drop by £418 a month. You save £418.

Not bad, that’s extra money in your pocket each month.

(I am assuming your mortgage provider lets you pay off chunks or if you can switch and get a lower mortgage … which might see you get you a lower interest rate from the smaller loan to value (vtr) ratio.)

But …

If we take the £418 saving each month multiplied by the remaining 240 months of the term, that equals an additional interest saving of £100,320. That’s correct, over £100,000!

Combining the interest saved on the mortgage with the monthly repayments savings, a clinic owner in this scenario saves one hundred and fifty thousand over the life of their mortgage.

Remember, this is just from paying £50,000 off the mortgage in five years time.

Clinic Owner Viewpoint

Higher interest rates ARE going to see monthly net income go down. Over the remaining life of your mortgage, if you stay the same, you ARE going to be TENS OF THOUSANDS worse off at the end of your mortgage because of total higher interest payments.

To maintain your current income, clinic owners HAVE to grow to earn more money to cover rising costs.

(And that is to stay still and meet extra payments, whilst still losing money over the life of the mortgage from the higher interest payments.)

What to do?!

Put prices up …? Start working evenings and Sundays ….?!

Seriously, you need a marketing strategy or business development plan to attract more patients, retain patients, get your staff busier, get more staff and get them busy and be more competitive.

Could be all of the above and/or or you need a service which adds to your practice and helps you grow.

To have £50,000 in five years, you actually only need an extra £10,000 a year income, net of tax. But you aren’t going to do that with your current set up and practice.

I started this article with mention of belt tightening.

The problem with belt tightening is as you cut down and get leaner, you have less income to grow your business.

It’s like crash dieting to lose weight where your metabolism slows down, you move less and have less energy. Its not a pleasant or sustainable weight loss strategy.

For clinic owners, the risk of cutting, (marketing or lower investment) and getting weaker is you become vulnerable, less able to ride the inevitable storms of clinic life, staff issues, personal health and any other curve balls. Plus other ambitious clinics or hungrier clinics are competing harder to take more or keep their share of the treatment pie.

Better to look at growth and building your business.

Lessons from Africa

Before I came into health care, I worked in Africa in a number of roles, primarily business development.

I’ve been to 34 countries and seen a lot of things. A lesson that stayed with me was that despite some challenging economic conditions, there were always local businesses thriving and who were strong.

The weak got weaker and the strong tended to get stronger. In the inevitable economic and political ups and downs, I observed that the stronger companies weathered the storms better. That lesson stayed.

Spine Specialism.

If you know me, you will probably be thinking I am teeing up this article to present the business case for the spine specialism IDD Therapy Spinal Decompression.

Well, if you are looking for a specialism to help your clinic grow, then this should resonate. You can do the maths and see that waiting another year or two to “think about it” will cost you thousands of pounds or dollars in missed income growth from the new service, lost investment opportunities from having more money and of course, losses from increased mortgage interest payments.

What I hope I am showing is a blinkers off, head out the sand reality that most clinic owners will be worse off if they stay the same in the current climate. And in some cases, clinic owners will be substantially worse off since they are not putting away enough for their pensions as it is.

So any drop in current income is by definition less money for investment today for tomorrow’s future. You should look at many different ways to grow your clinic and take this insight away with you.

What does Warren say?

Warren Buffet says the best way for most people to invest is in index-linked tracker funds which, over time, outperform the fund managers. That is solid investment advice, though you do need cash flow for that.

Buy to let is a minefield right now with changing regulations. A 25% deposit on a £300,000 property for example is £75,000 (!) and using MetroBank, they charge 8.5% on buy to let mortgages.

There are ways no doubt to make money in property today but you still need some cash and time. In the short term/ current climate where house prices are expected to fall, it is risky given the volatility.

If you know how to mine crypto and make money great, or you could start a different business / side hustle.

But my absolute conviction from working with clinics for over ten years is that the best asset for a clinic owner to develop more income through is their business.

If your business isn’t rammed, consider a business coach to learn how to get more from the business. And look at all the service models and specialisms to see what fits for you.

Our interest is conservative spine care, which also happens to be the biggest category in MSK medicine.

If you are seen as the Go To Spine Clinic, you will attract more patients and patients who need more care than those with just a sprained ankle.

The Spinal Suite. We help clinic owners help back pain sufferers avoid injections and surgery with IDD Therapy Spinal Decompression. They get to give patients their life back with programmes of rehab with a specialism aligned to their core competencies of the clinic – spine care.

Some clinic owners may be concerned that the public is going to spend less on treatments in the future. Fortunately or unfortunately, it is increasingly challenging for patients to access treatments in the NHS and more people cut the wait time by going to private clinics.

But with back pain, especially unresolved spinal pain which is dramatically impacting life quality and where the alternatives of pain management, injections and surgery are not desirable at all, patients in this category of need are prepared to pay to get their quality of life back, where for some getting effective conservative treatment is the difference between being able to work or not.

You can look at all services to grow your clinic to consider the possibilities. With IDD we aren’t actually interested in generating an additional £10,000 a year. We want a thriving spine service.

Patients come to the clinic because you have the programme. So it is additional revenue. If you want to see the full business model, costs and revenue of IDD Therapy Spinal Decompression, then contact me (details below) or download a “Become A Provider” prospectus at www.iddtherapy.co.uk/become-a-provider.

If you are in the USA, go to www.mydiscclinic.com. The US has higher treatment prices generally than elsewhere. You can assess the ROI for yourself.

Investment

We can’t grow many things without investing something.

With the Accu SPINA there is a modest deposit to take delivery of your system and then monthly lease payments. If you want to, you can even start payments two or three months after you start, but the aim is to get patients from the get-go.

The key thing to consider is that just one patient a month covers the lease AND generates a profit. As all of the clinics we work with will show, you can develop a substantial new income stream, especially if you lean in to the programme and focus your clinic as a specialist centre (something we help with).

You can grow to put £1,000 aside to pay off your mortgage earlier and have additional income and profit by working on your spine specialism. As I write this I consider additional benefit on the five year time horizon.

The Accu SPINA is an asset. Most people fund this asset with a lease over five years, the last payment transfers ownership to your clinic. Average lease payments are £850ish or $1,000 a month.

After five years of making profits from the asset, you own it. There are no more lease payments. That lease payment goes into your pocket. It’s an immediate monthly pay rise in five years time.

More money for investment, retirement plans or taking a day off each week to work ON your business or just relax. And since your revenue, profit and asset base have all increased, the value of your business has also risen to future buyers.

What next?

There is no easy passive income system for clinic owners. But, with IDD Therapy spinal decompression in the practice, clinic owners help patients with disc problems and at the same time, they make a significant difference to their income, profits and future prosperity.

If you would like to know more about developing your conservative spinal suite, helping patients and growing your clinic, book a call or clinic visit with me.

By Stephen Small

Clinic Development Director

Book a call: https://calendly.com/stephen-small

https://www.linkedin.com/in/stephen-small-0b404718/

Download a prospectus www.iddtherapy.co.uk/become-a-provider or www.mydiscclinic.com